Facing the Storm With This Emerging Markets Bond Fund

US10Y…

-0.97%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DXY

+0.13%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

TEI

-1.52%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

If you think about what the best-performing areas of fixed income are in 2023, you might land on junk bonds or maybe even senior loans. In reality, the biggest winner has been local currency emerging markets bonds, up about 8% on the year. While emerging markets equities have been underperforming thanks to a tepid China COVID reopening, EM debt has looked comparatively attractive. Many major emerging markets have gotten inflation reasonably back under control and are now considering loosening monetary policy to begin addressing the global growth slowdown. Add in high yields and a falling dollar and you’ve got a fairly favorable set of conditions.

It’s a segment of the bond market that needs to be carefully risk-managed. Those high yields come with high risks and investors can quickly find themselves underwater if conditions change quickly. The Templeton Emerging Markets Income Closed Fund (NYSE:TEI) has a portfolio structure that attempts to balance some of those risks out, but delivers a yield that investors will certainly find attractive at the moment. It’s a classic example of trying to determine if the extra return potential is worth the risks that an investor needs to take to achieve it.

Fund Background

TEI seeks high current income, with a secondary goal of capital appreciation, by investing primarily in the income-producing securities of sovereign or sovereign-related entities and private sector companies in emerging market countries. These securities will mostly be issued in local currencies, which means fluctuations in the dollar relative to these currencies will add to or detract from returns. The fund also utilizes a modest degree of leverage in order to enhance yield and total return potential.

Fund Information

Fund Information

The lack of a dollar hedge (although some positions can be hedged to limit risks) means that investors probably need to consider where they think the forex market is headed. A weak dollar could make TEI look more attractive. Foreign currency exchange is notoriously challenging to predict and investors might need to be willing to simply accept some extra risk in pursuit of higher yields and returns. While the fund is able to invest in both corporate and government bonds, it’s the latter group which TEI is almost entirely invested in. These governments have both investment-grade and junk ratings, so credit risk is very much a factor in this portfolio. The net expense ratio of 1.38% is pretty middle of the road.

Portfolio Statistics

Portfolio Statistics

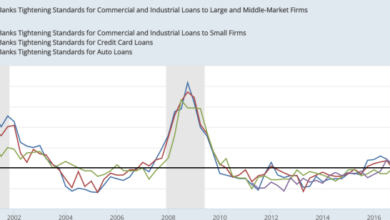

The fund’s positioning relative to its broader emerging market bond index benchmark can be summed up by two conclusions – its lower effective duration means that it’s less susceptible to interest rate risk, but the higher yield to maturity on the fund’s component securities means that credit risk is higher than average. This isn’t necessarily a good or bad thing as long as investors know what they’re getting into, but it could mean extra trouble should the current global slowdown extend into recession. EM bond spreads aren’t quite as low as they are in the United States, but they’re probably still below where they should be given macro risks. That means TEI may have significant downside vulnerability should spreads blow out over time. The lower interest rate risk could provide some benefit, but it’s unlikely to outweigh the fund’s credit risk profile.