Buying Gold Miners May Make Sense Now

Earlier on Wednesday, I was bemoaning my completely ham-handed screw-up of a super-clean trade, which was go to very long the VanEck Junior Gold Miners ETF (NYSE:GDXJ) (junior miners). This trade had going for it, but I managed to mess it up anyway! But I’m going to get that sour taste out of my mouth—as well as the sour taste of anything to do with gold disappointing me so many times —and offer up the notion that maybe, just maybe, gold miners make sense now.

Let’s start off with the EUR/USD, which has the Euro grinding down to, incredibly, sub-par values! My view here is that we might be setting up for a bounce up to that trendline.

EUR/USD Chart

EUR/USD Chart

If that happens, the US dollar will weaken, and gold should strengthen, which would likewise set up gold (shown here by way of the /GC futures) back up to its own broken trendline. Keep in mind, this is a swing trade, probably measured over the span of a couple of weeks. It isn’t a long-term setup.

Gold Futures Chart

Gold Futures Chart

Thus, junior miners (GDXJ below) would participate in the rally. It seems to me 29.80 is a good, clean stop-loss price.

GDXJ Chart

GDXJ Chart

The funny thing is that, as clean as GDXJ looks, I went through 70 different charts of individual miners and found hardly any that looked appealing. I will say, however, that the three below looked not-too-terrible, maybe even as long-term holds!

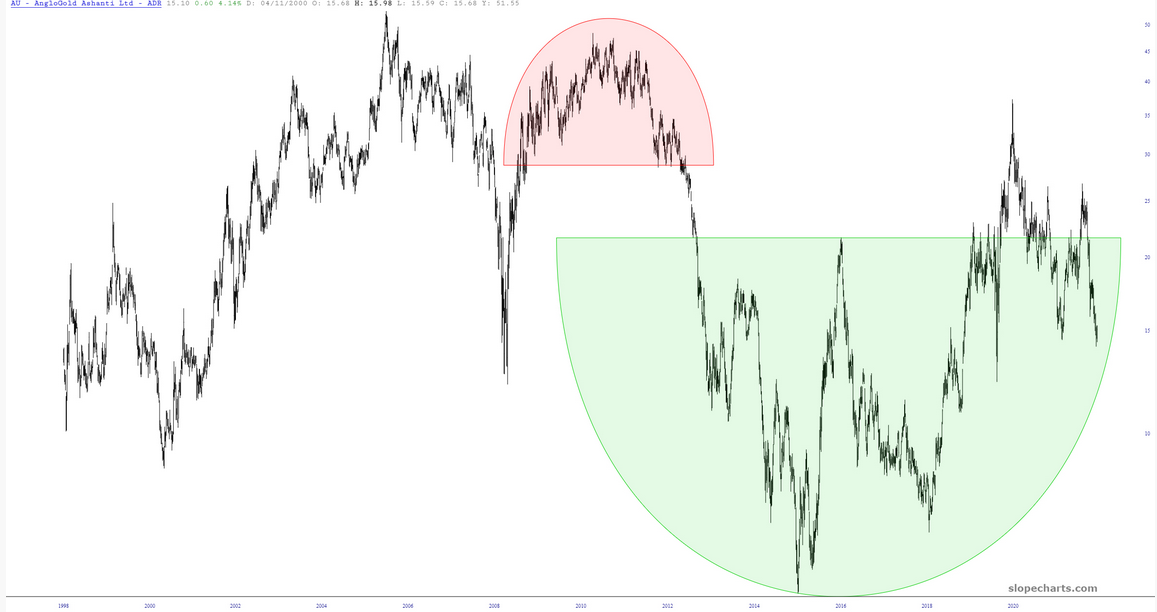

AU Chart

AU Chart

AngloGold Ashanti (NYSE:AU).

FNV Chart

FNV Chart

Franco-Nevada Corporation (NYSE:FNV).

RGLD Chart

RGLD Chart

Royal Gold Inc (NASDAQ:RGLD).