Ethereum: Pullback and Then Higher Again?

ETH/USD

+0.69%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

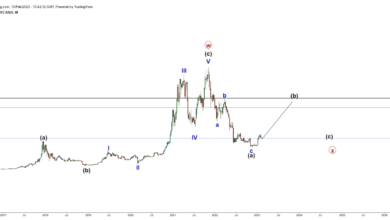

Last week, we found:

“Ethereum (ETH) made an almost picture-perfect Fibonacci-based impulse pattern…from last week’s low where green waves 1, 3, and 5 topped and bottomed almost precisely where they ideally should…So, red W-i/a has most likely topped, and red W-ii/b to ideally $1690+/15 should now be underway but may already have bottomed yesterday at around $1700. Thus, the next rally will announce itself on a break above $1760 and should then target at least $1800 but preferably ~$1925+ for red W-iii/c…Thus, a low-risk/high-reward setup is in play because ETH must hold last week’s low at $1622 to allow for this path to unfold.”

Those green Waves 1, 3, and 5 are highlighted in the blue box in Figure 1 below. More importantly, ETH had indeed already bottomed out for red W-ii/b in the ideal (red) target zone. It broke out above $1760 hours after we posted our update and reached $1933 on the 22nd and $1935 on the 23rd. See Figure 1 below. Undeniable proof of how well the EWP works.

Figure 1

ETH/USD Hourly Chart

ETH/USD Hourly Chart

So, red W-iii/c has most likely topped, and red W-iv to ideally $1805-1840 may have bottomed yesterday at $1838. Red W-v to ideally the 176.40-200.00% Fibonacci-extension of red W-i/a, measured from the red W-ii/b low, at $1945-1975 should now be underway. This Fibonacci-based path is like the one shown last week but simply one wave degree higher.

Thus, as long as yesterday’s low at $1838 holds, we can allow Ethereum to reach, ideally, $1945-1975. But, if ETH’s price breaks below that low first, then red W-v already topped at the secondary high of $1935 on June 23rd. This option is shown by the red alt: iv, v? sequence. We should then look for a retrace to around $1770+/-25 before the next more significant rally takes place, which can propel ETH to as high as $2300+. However, since financial markets are fractal, we can apply the same Fibonacci-based impulse pattern at all wave degrees. Thus, even a rally to $1945+ will be followed by a similar retrace and a similar rally. Accordingly, please consider the short-term risks vs. the intermediate-term rewards.