Price Action Grows More Unstable Ahead of Jobs Report: Where Will Rally Top Out?

NVDA

-5.55%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

NQM24

-0.52%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

AVGO

-6.99%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Yesterday was a bizarre day across the board, from market price action to some strange Q&A with Powell in the Senate to Broadcom’s (NASDAQ:AVGO) bizarre post-earnings price action. There are just some days where you can say – ‘yeah, nothing made sense.’

Looking forward to today’s jobs report now.

I mean, first, there was an overnight trading session that saw the futures fall quite a bit, only to see them mysteriously rally starting around 3 a.m. on no news whatsoever—or any that I could find.

From the low at 3 a.m. to the high at 2 p.m., the Nasdaq rallied by almost 2.5%, really for no good reason other than the fact that it appears that the stock market has officially turned into a hyper-casino. Nasdaq Futures Chart

Nasdaq Futures Chart

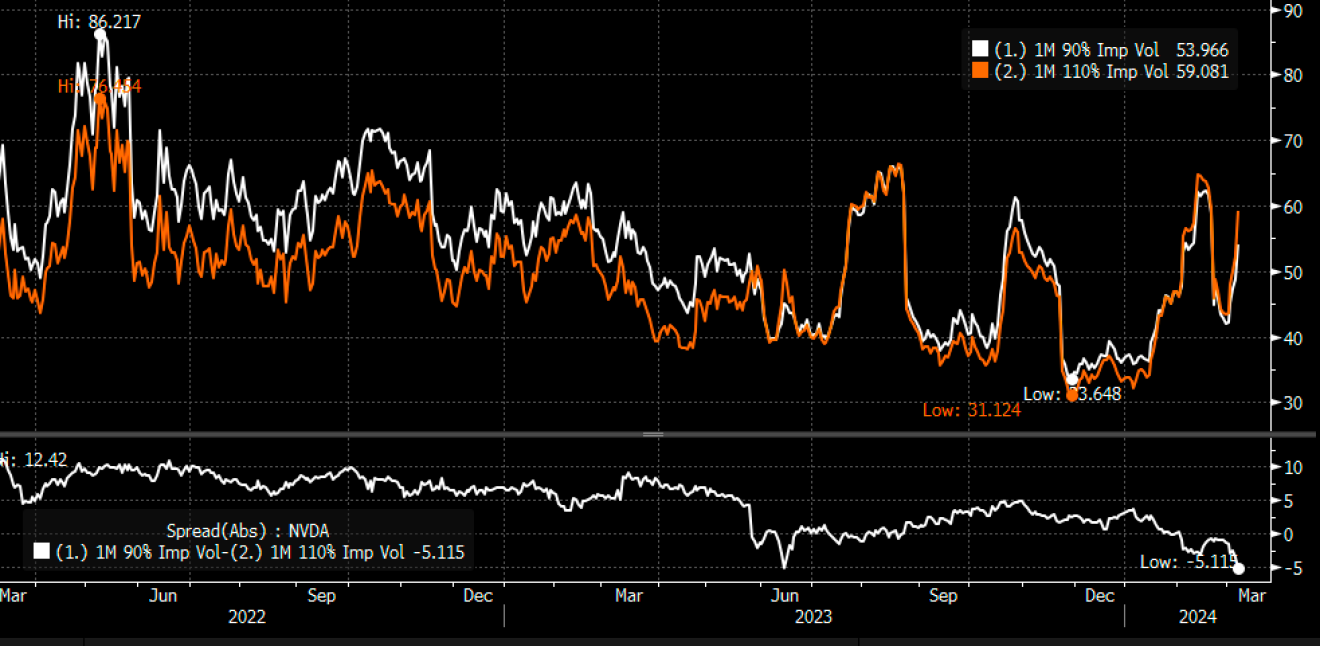

In addition, we saw the spread between a 1-month 90% moneyness and 110% money Nvidia (NASDAQ:NVDA) options fall to -5.1 today, the widest spread over the past two years.

That means IV for a 10% upside in Nvidia is higher than for a 10% downside. Maybe investors are now pricing not only the GPUs Nvidia is selling but all the diseases and cures AI will solve someday. NVDA Options Activity

NVDA Options Activity

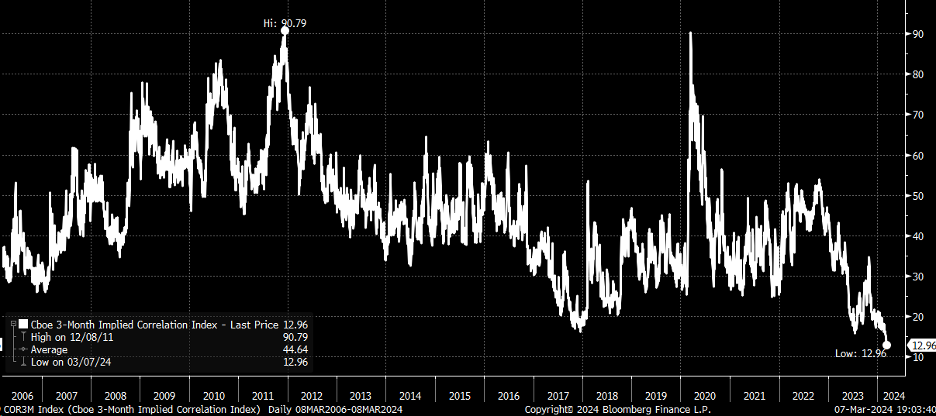

In the meantime, the 3-month implied correlation index hits its lowest level ever today.

3-Month Implied Correlation Index

3-Month Implied Correlation Index

These just don’t feel like things you typically see during periods of level-headed thinking and feel much more like something of a manic nature.

Of course, Broadcom, whose stock has surged 70% since the beginning of November, reported what I thought were the most unimpressive results given the run and missed estimates on its semiconductor segment and then provided inline guidance, with nothing special talked about on the conference call.

It is surprising to see that shares have only fallen a mere 3% when we have seen stocks punished far worse for what seemed like decent numbers.

Maybe that will change today. I don’t know, but the price action we are seeing currently seems unstable. It can go on for longer, but none of this seems normal, and I have seen some bizarre things over the past 30 years.