Earnings Week Ahead: Adobe EPS Expectations Raised, Dollar General Overvalued

ADBE

+1.58%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DG

+1.26%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DKS

-0.35%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ASAN

-0.95%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

- Adobe: Analysts slightly increased EPS estimates ahead of Q1/24. Our Fair Value models suggest a potential 5.7% increase in stock price.

- Dollar General: The stock might be priced higher ahead of Q4/24. Fair value analysis indicates a 14.9% downside.

- Dick’s Sporting Goods: EPS estimates raised before Q4/24. However, Fair Value models indicate the stock is overvalued.

- Subscribe to InvestingPro now for under $9 a month and never miss another bull market again!

Here is your Pro preview of the major upcoming major earnings reports next week: Adobe, Dollar General, Dick’s Sporting Goods, and Asana.

Adobe

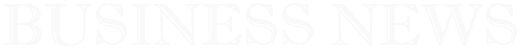

Adobe Systems (NASDAQ:ADBE) is set to release its Q1/24 earnings on March 14, after the market close. The consensus among analysts predicts EPS of $4.38 and revenue expectations of $5.14 billion.

A review of EPS Forecast Trends by InvestingPro shows a modest upward revision in EPS forecasts for the quarter, marking a 4.2% rise from the initial estimate of $4.20 to $4.38 over the last 12 months.

ADBE

ADBE

Adobe has consistently outperformed EPS and revenue estimates over the last four quarters.

ADBE

ADBE

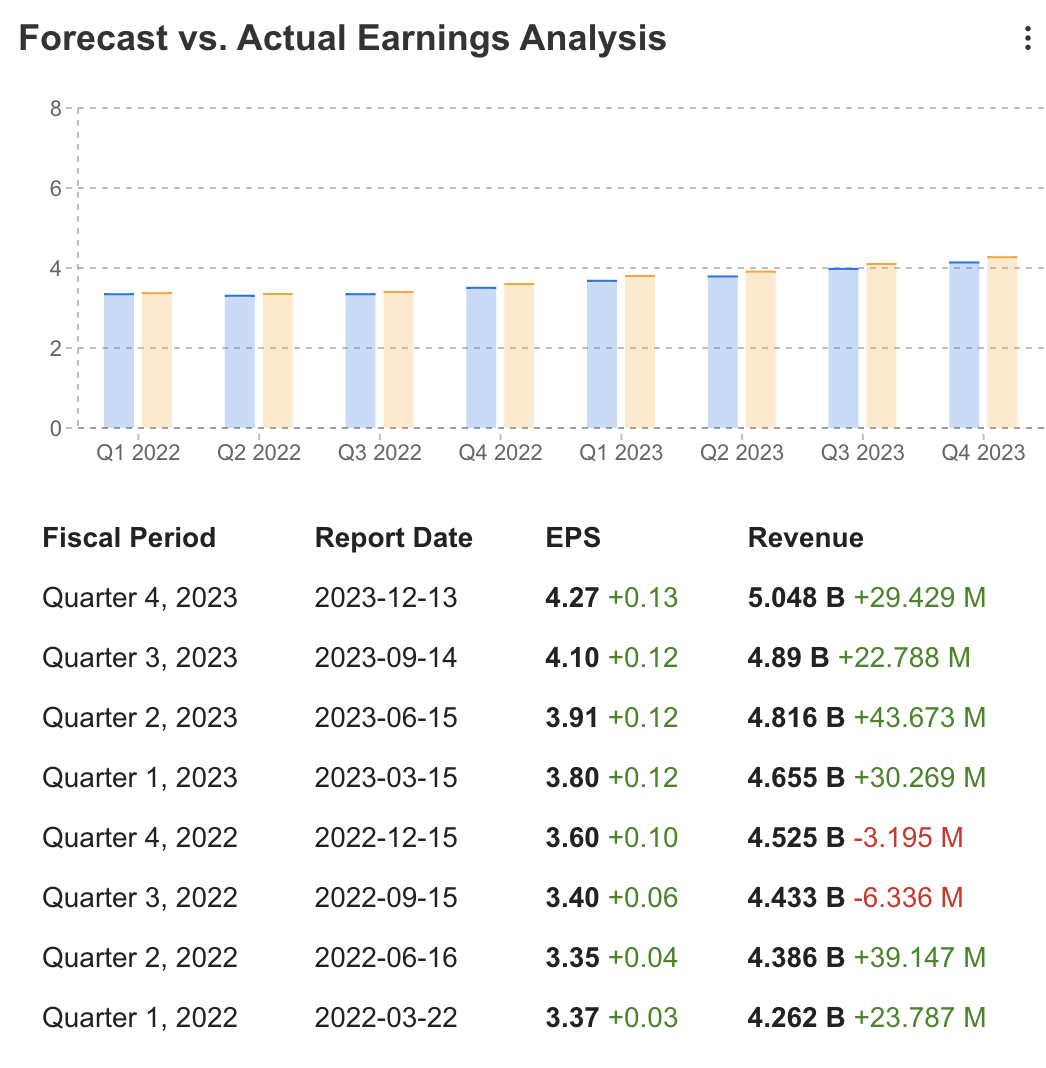

According to InvestingPro’s Fair Value analysis, Adobe’s stock appears to be slightly undervalued, with a calculated fair value of $583.36. This assessment indicates a potential upside of 5.7% from the recent closing price. Furthermore, analysts suggest the stock could see an approximate 17.1% increase in price.

ADBE

ADBE

Dollar General

Dollar General (NYSE:DG) is scheduled to announce its Q4/24 earnings on March 14, before the market opens. The consensus among analysts is set at an EPS of $1.73, with revenue expectations of $9.77B.

An analysis of EPS Forecast Trends by InvestingPro reveals a stark downward adjustment in the anticipated EPS for the quarter, marking a 43.6% reduction from the initial estimate of $3.07 to $1.73 over the past year, largely due to a disappointing Q2 reported in August 2023.

DG

DG

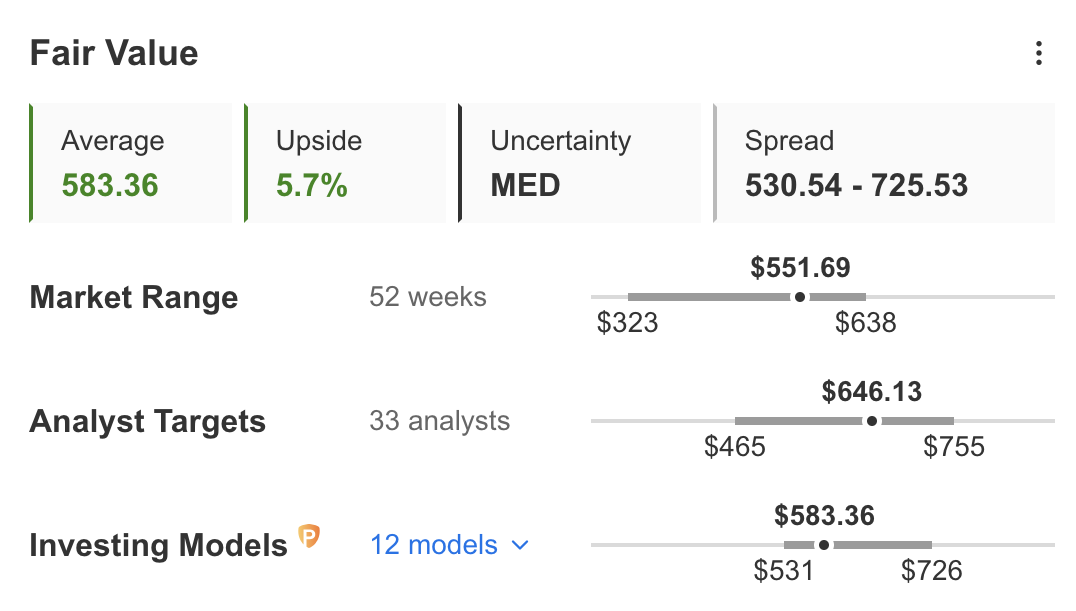

According to InvestingPro’s Fair Value analysis, Dollar General’s stock appears to be overvalued, with a calculated fair value of $134.03. This evaluation indicates a potential downside of 14.9% from the stock’s recent closing price. Additionally, analysts suggest that the stock could face a possible decrease of around 9.8%.

DG

DG

Dick’s Sporting Goods

Dick’s Sporting Goods (NYSE:DKS) is set to unveil its Q4/24 earnings on March 14, before the market opens. The consensus among analysts forecasts an EPS of $3.36 and revenue of $3.79B.

InvestingPro’s EPS Forecast Trends indicate a positive shift in EPS expectations for the upcoming quarter, climbing from $3.12 (before the Q3 beat in November 2023) to $3.36 at present.

DKS

DKS

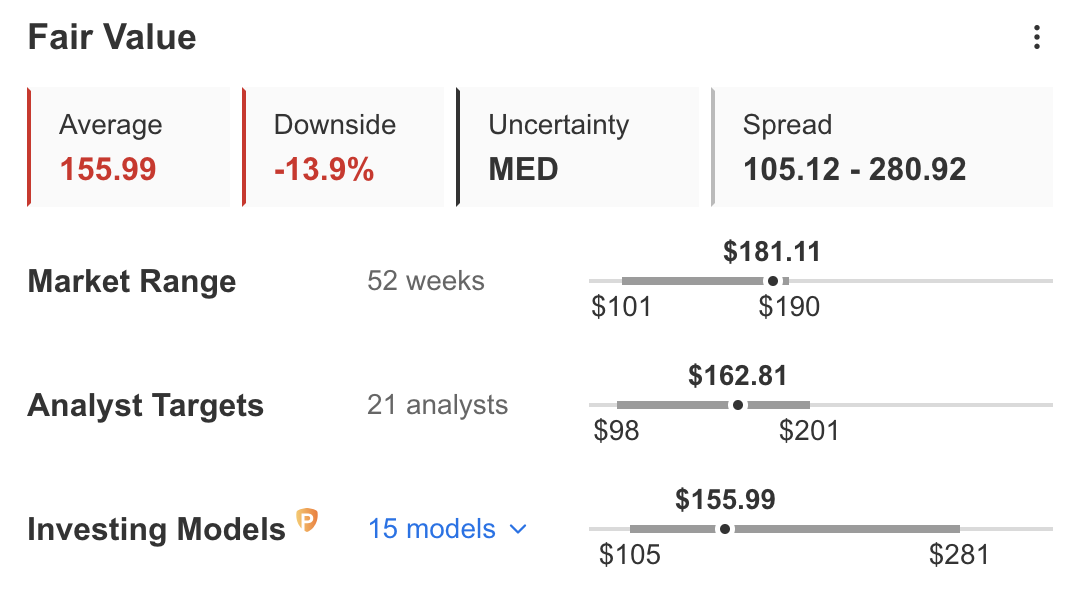

Despite the optimistic EPS trend, Dick’s Sporting Goods’ stock is currently deemed overvalued according to InvestingPro’s analysis, with a fair value estimation set at $155.99. This valuation points to a possible 13.9% decline from the stock’s last closing price. Market analysts also anticipate a potential price decrease of about 10.1%.

DKS

DKS

Asana

Asana (NYSE:ASAN) is set to release its Q4/24 earnings on March 11, after the market close. The consensus among analysts anticipates an EPS of ($0.097) alongside revenue predictions amounting to $168 million.

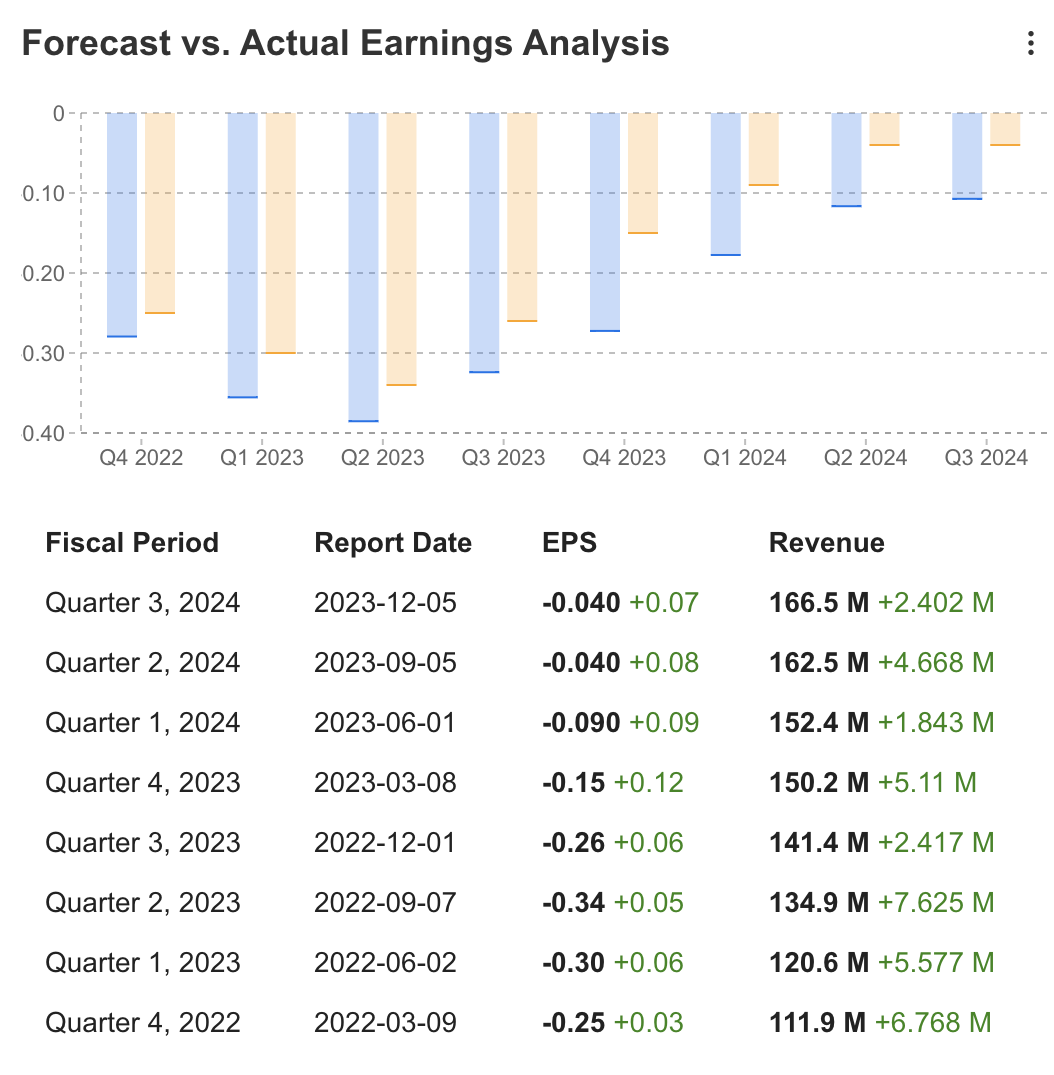

Remarkably, Asana has surpassed EPS and revenue expectations consistently over the past eight quarters.

ASAN

ASAN

In addition, InvestingPro’s analysis of EPS Forecast Trends reveals a notable upward adjustment in the forecasted EPS for the upcoming quarter, with a 43.8% increase from an initial prediction of ($0.17) to the current ($0.097) over the last twelve months.

ASAN

ASAN

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it’s crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

new year

new year

*Readers of this article get an extra 10% off our annual and 2-year Pro plans with codes OAPRO1 and OAPRO2.

Disclaimer: