3 Mid-Cap Stocks That Blend Stability and Explosive Growth

HP

+2.93%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

GES

-0.27%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DAR

+0.90%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

- Mid-cap stocks strike a good balance between growth potential and stability.

- In this piece, we will explore promising opportunities with three mid-cap companies positioned for growth.

- These companies may provide stability along with higher-than-expected growth potential compared to the average mid-cap stocks.

- Subscribe to InvestingPro for under $9 a month and get 70+ AI-powered market-beating stock picks every month!

Mid-cap stocks can sometimes offer unique investment opportunities by combining growth potential with relative stability.

Unlike small caps, which can be risky yet offer significant growth potential, and large caps, which can be stable but provide slower growth prospects, mid-caps strike a balance between both.

This article delves into three mid-cap companies – all of which are positioned for hefty potential gains.

1. Helmerich and Payne

After posting stronger-than-anticipated Q1 results in January, Helmerich and Payne (NYSE:HP) experienced increases in price targets and positive revisions of estimates by analysts.

Piper Sandler raised its price target for Helmerich & Payne to $44.00 from $41.00, reiterating its Neutral rating.

Morgan Stanley increased its price target to $46.00 from $44.00, keeping an Underweight rating. Barclays adjusted its price target to $42.00 from $40.00, maintaining an equal-weight rating.

The trend in analyst EPS forecasts for Helmerich & Payne for the forthcoming quarter is showcased by InvestingPro’s EPS Forecast Trend, indicating an increase from $0.73 in January (before earnings announcement) to $0.87 at present.

Upcoming Earnings

Upcoming Earnings

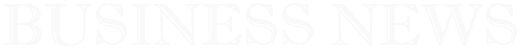

The ProTips summary on InvestingPro offers a concise overview of the company, highlighting key strengths such as aggressive share buyback activities by management, upward revisions of earnings forecasts by 8 analysts for the next period, and a consistent record of dividend payments for 54 years in a row.

ProTips

ProTips

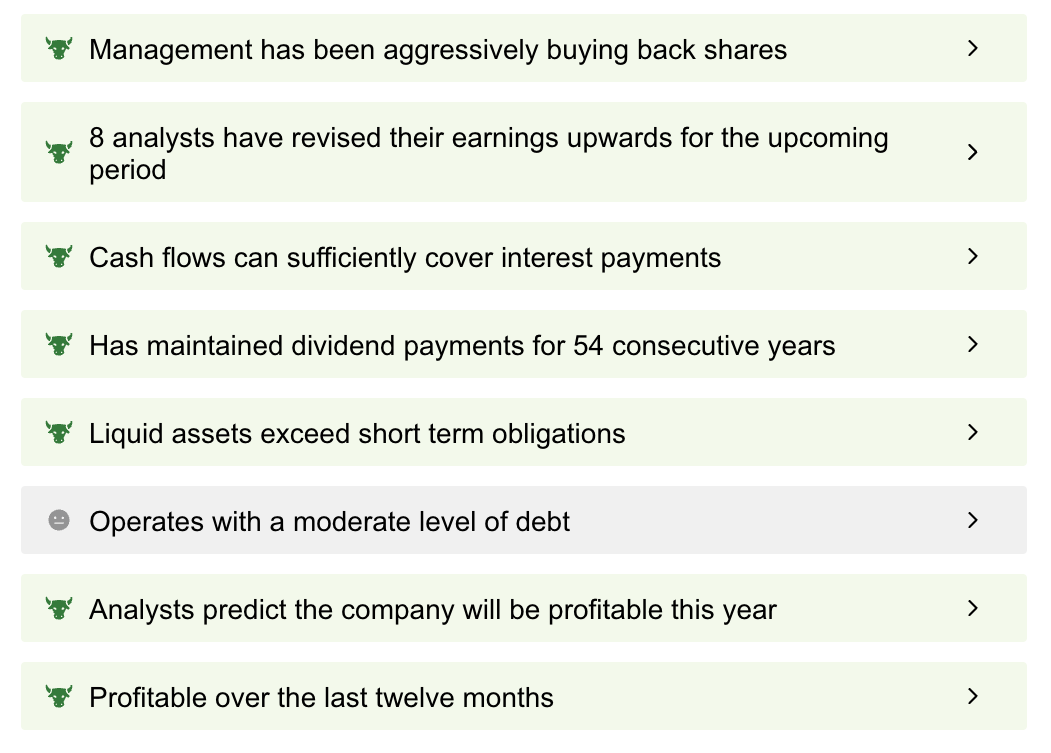

Furthermore, InvestingPro’s Fair Value analysis suggests a potential 33.3% increase in the stock price, whereas Wall Street analysts project an average growth of approximately 17%.

Fair Value

Fair Value

2. Darling Ingredients

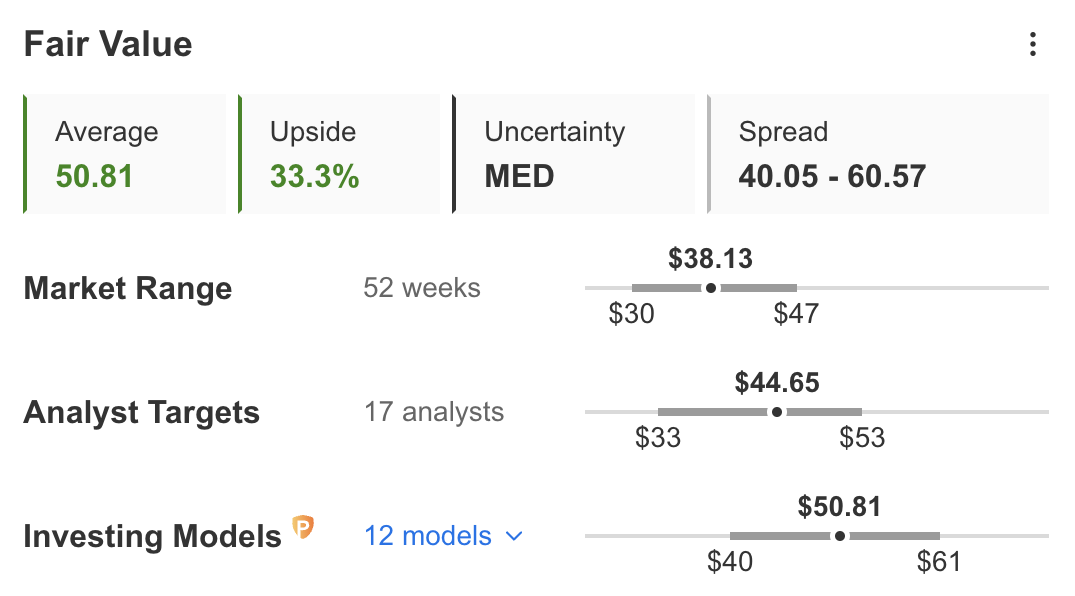

Last week, Darling Ingredients (NYSE:DAR) reported EPS and revenue figures for Q4 that fell short of expectations.

Additionally, the company withdrew its EBITDA guidance for 2024, stating it would provide an update along with the Q1/24 results as visibility improves—a decision that initially negatively impacted the stock. However, the shares have since rebounded, erasing the initial losses and even posting slight gains.

In response to the announcement, several Wall Street firms revised their price targets downward for Darling Ingredients. Stifel reduced its price target to $95.00 from $120.00 but kept a Buy rating. UBS cut its price target to $72.00 from $75.00, also maintaining a Buy rating. BMO Capital decreased its target to $57.00 from $60.00, maintaining an Outperform rating, and noting:

We lower estimates, reduce our target to $57, and expect the shares to be limited in the near term. However, we reiterate Outperform as we see attractive risk/ reward with 2024 EBITDA likely north of $1.5 billion and a stronger earnings outlook beginning in 2025.

The company shares fell 38% since July 2023 highs following three consecutive earnings misses.

Actual Vs. Forecasts

Actual Vs. Forecasts

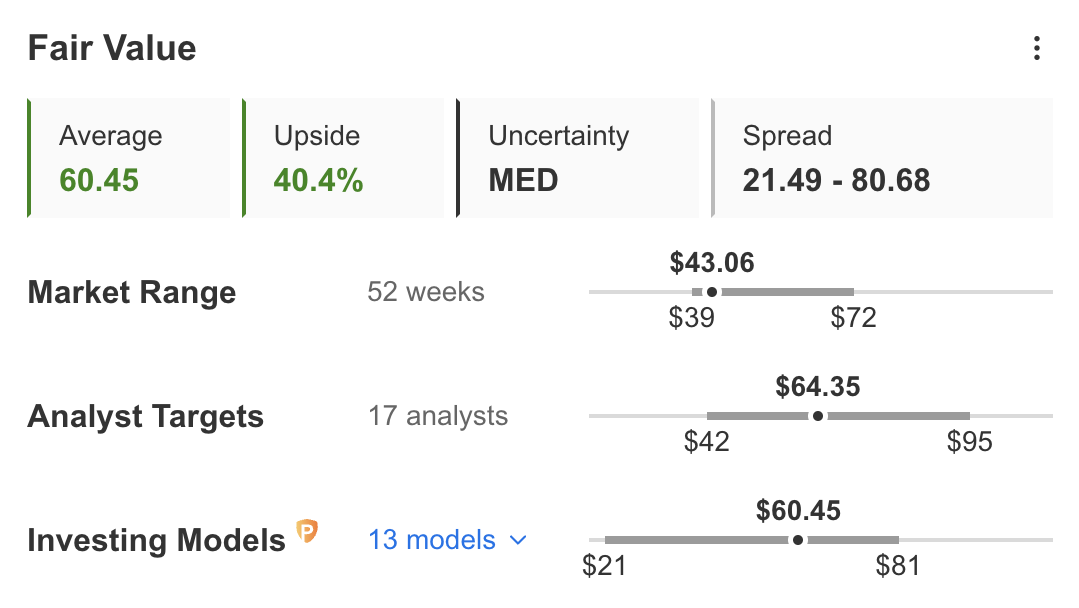

Current Fair Value assessments indicate the stock is undervalued. Investing models predict a 40.4% potential upside in the stock price, while Wall Street analysts estimate about a 49% increase.

Fair Value

Fair Value

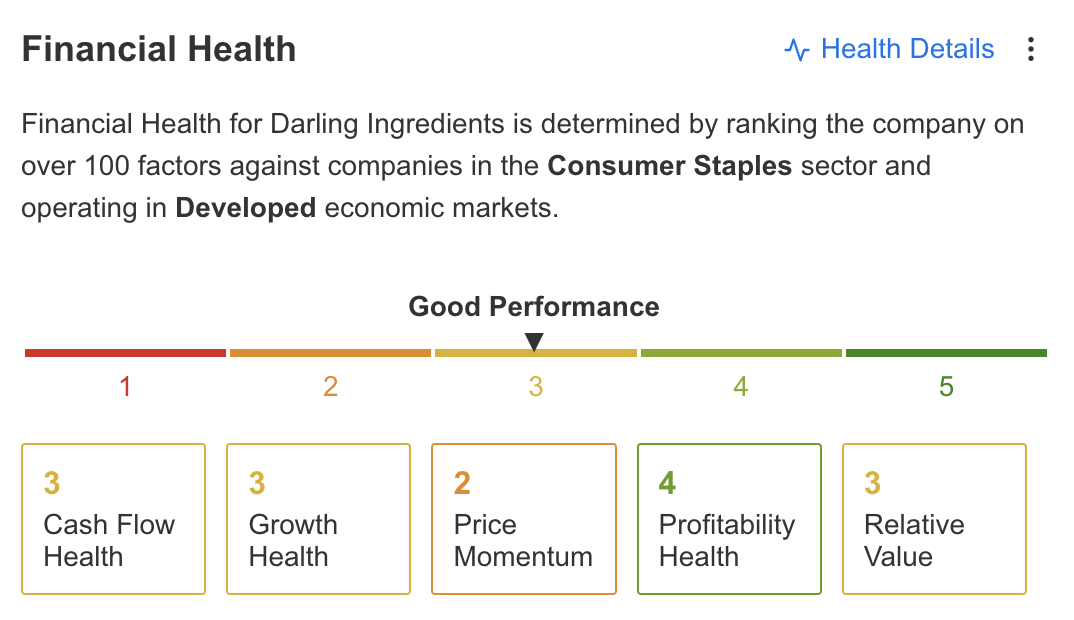

InvestingPro also gives Darling Ingredients a “Good” rating in financial health, comparing over 100 factors against peers in the Consumer Staples sector and within Developed economic markets.

src=

src=

3. Guess?

Guess? (NYSE:GES) is scheduled to announce its Q4 earnings on March 20. During its last quarterly earnings announcement in November 2023, Guess? projected its EPS for Q4 to be between $1.53 and $1.60. The current consensus estimate is at $1.54.

Upcoming Earnings

Upcoming Earnings

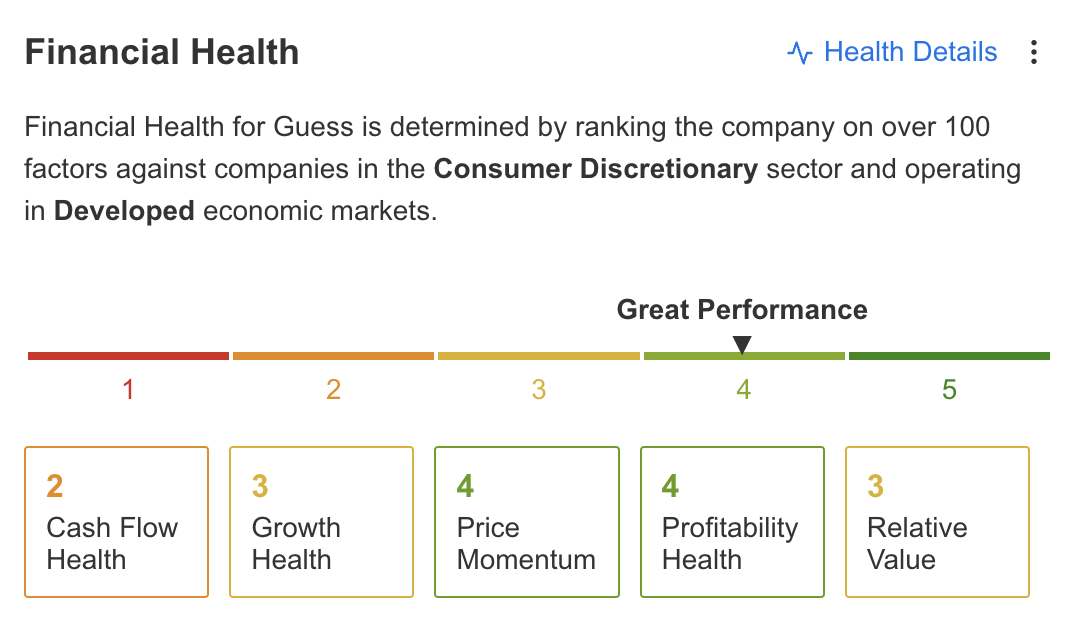

InvestingPro rates the company’s financial health as “Great” when compared to over 100 factors against companies in the Consumer Discretionary sector and operating in Developed economic markets.

src=

src=

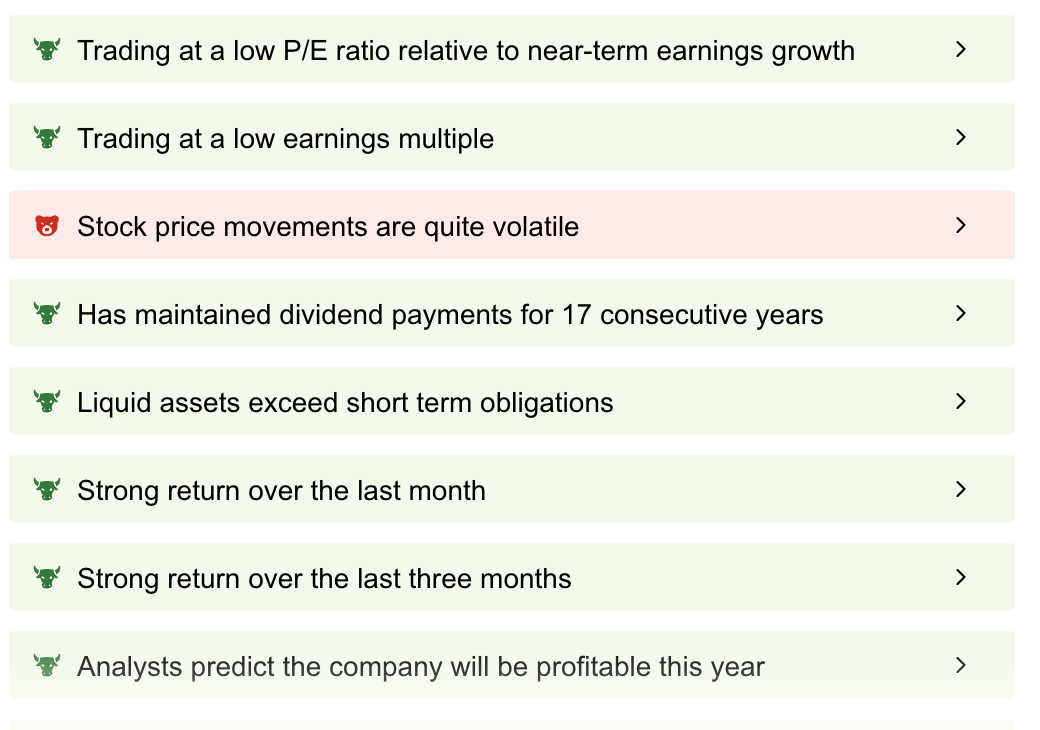

The ProTips summary on InvestingPro offers a brief overview of the company, highlighting key strengths including trading at a low price-to-earnings (P/E) ratio in comparison to near-term earnings growth, consistently paying dividends for 17 years, increasing dividends for the past three consecutive years, and achieving a strong return over the last three months.

ProTips

ProTips

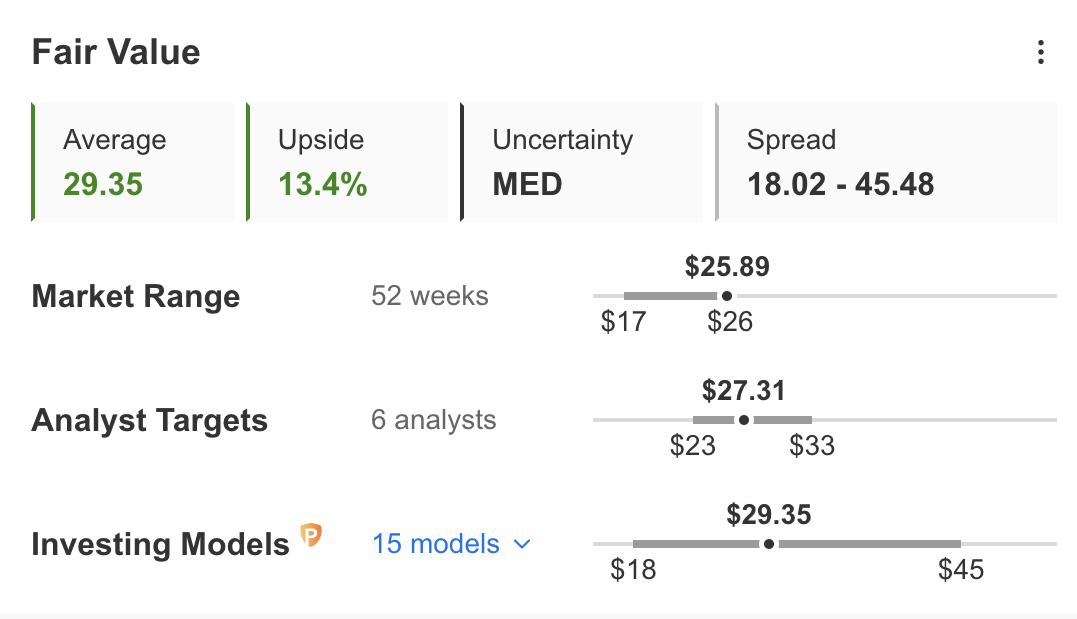

Furthermore, InvestingPro’s Fair Value models indicate that Guess?’s stock is currently undervalued. Investment models forecast a 13.4% potential increase in the stock price, while Wall Street analysts expect an approximate 5.4% rise.

Fair Value

Fair Value

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it’s crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

Subscribe Today!

Subscribe Today!

*Readers of this article get an extra 10% off our annual and 2-year Pro plans with codes OAPRO1 and OAPRO2.

Subscribe here and never miss a bull market again!

Disclaimer: